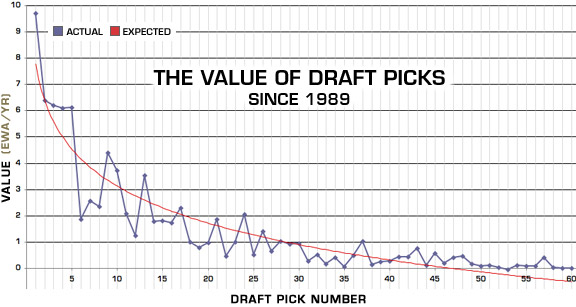

Zach Lowe had an article up today on Grantland about the current view around the NBA that draft picks are extremely valuable assets for teams to stockpile and use in future trades. He explains:

The word "asset" has never had more currency in the NBA. Draft picks, even in the 20s, are "assets" teams can use to acquire cheap talent, or to grease the wheels in potential mega-trades for star players. The Celtics view the three unprotected picks they nabbed from the spend-spend-spend Nets not just as young players that will don the hallowed green, but as "assets" carrying the lure of the unknown for a rival GM looking to move a disgruntled star.Luckily for us, someone has already gone to the trouble of valuing NBA draft picks and the results should be sobering to teams clutching likely mid- to late-first round picks and hoping for the next Tony Parker.

|

| Source: ESPN.com |

Even teams holding picks they think will be at the top of the draft should look carefully at the rate of team performance mean reversion in the NBA (see this post from last year) and be realistic about where the pick will be.

I can see two primary reasons for the run-up in value of picks relative to real, actual players - besides the momentum of "everyone is doing it."

- The 2011 CBA – The NBA went to a lot of trouble, and cancelled a lot of games, to get a very owner-friendly collective bargaining agreement in their latest negotiations. They got it. Here’s the tricky part though: the CBA is owner-friendly because the owners agreed to tie their own hands. The luxury tax has such teeth that only a few owners are willing to venture into that territory. The alternatives to splashing out on role players to put around your stars are limited – you can find players at the minimum salary and various exceptions or you can plug in players on their rookie deals. Of course capped-out teams can’t just go out and sign these players but as we saw this summer with Brooklyn, nature finds a way. This is the proximate reason for the new interest in picks in the last couple years.

- Bias – Prospect theory tells us that people in decision making tend to overestimate small probabilities – e.g., a draft pick turning out to be very high – while underestimating high probabilities – e.g., a draft pick turning out to be not very high. This bias leads to a kind of over-optimistic evaluation of draft picks. For example, I may know that there is only a 2% chance that a given pick will be the number one overall, but I feel like it has an 6% or even 8% chance. This sounds small but when you’re looking at an expectation of Chris Webber with the 1st pick or Erick Dampier at number 10, the adding a little bit of Webber matters more than a lot of Dampier. Experiences like the Cleveland Cavaliers pulling out the first overall pick in 2011 not with their own 19.9% chance but with the Clippers’ 2.8% chance are not likely to persuade teams to be realistic. The effect of the Winner’s Curse also comes into play here as the team with the largest bias about the future value of the pick is most likely to secure the trade (though it’s harder when the currency is current players with their associated specifics – contract, position, age etc. – so the team trading away the picks may have certain preferences that cause them to turn down the “best” deal).

So if draft picks aren’t likely to be a full-on bubble – the CBA will remain in force for at least the next 4 years and biases are tough to fully eliminate from decision making – they are still likely to disappoint on the whole as long as the biases play a role in the valuation. In addition, if the next CBA represents a softening of the tight luxury tax rules or an increase in the compensation to rookies then some teams holding picks for drafts beyond the dual CBA opt-out in 2017 (either side may opt to end the deal, making it pretty likely that one side will) may find themselves really out of luck.

No comments:

Post a Comment